Interview with Vasa Segrt, CEO of NF Innova

It’s always inspiring when you get the opportunity to hear about other people’s success stories. That’s why today we’re talking with Vasa Šegrt, who is the CEO of NF Innova, which is a part of New Frontier Group. Vasa brought great experience into the field of digital banking, from when he worked in outsourcing of custom software development services. This experience granted him a clear vision of the obstacles, dangers, and benefits of the product-related and service-related business. For those of you unfamiliar with NF Innova, we are 100 % percent sure to claim that it’s one of the leading companies when it comes to Digital Banking, which has set a very high bar of quality criteria, when it comes to the transformation of today’s prime financial institutions, thanks to its digital banking platform and four-pillars customer engagement business model.

We think that free time is crucial for brainstorming and the creative process, so how do you spend your free time, when you’re not being a super busy CEO

As all busy people do, in my opinion, I spend most of my free time with friends and family, in outdoor activities. On weekends I prefer to go to the gym and spa since we all need some relaxation. Also, traveling is my passion, so I travel whenever there’s a chance for it.

The Digital revolution is changing our world very fast, so naturally, digitalization is a buzzword nowadays. Just twenty minutes of scrolling through Linkedin is enough to see that there are too many different interpretations of digitalization and digital transformation. What does the term ‘digital transformation’ mean to you and NF Innova and is the phrase “Digitize Or Die” true?

The current business environment changes rapidly and significantly. Digital start-up companies and other global players create new competition. Value is assigned to the new participants in the supplier chain, based on the use of new services and products, which is again, based on new technologies. The key question raising for every company is – HOW to adapt to new changes and secure the future. The answer lies in digital transformation. Many people perceive it as a technological issue. For us, this is a critical issue for every company and it needs to be dealt with the help of the top management. They should not fear, as this is not the matter of technology, even though the technology is the source of the digital revolution.

How does this reflect on banking? We can see more and more FinTech every year. Naturally, most of them do not survive the startup phase, but many of them who survive will attack the banks with low margin, cheap service, and constant omnichannel availability. Only this year, it’s expected that FinTechs in the United States will receive investments in the amount of $20 billion. Can this jeopardize the banking business?

PSD2 regulation and in general open banking just might change this forever as it will be much easier for players out of the banking industry (for instance Fintechs, non-banks) to enter this until now highly fenced territory. There is no doubt, that these newcomers will play a significant role in the future of the financial landscape. As there are now only a few months left until PSD2 will become effective and currently it seems it represents as many challenges to the bank as opportunities. The question is how banks perceive it? They need to decide how far they want to go with open banking. As PSD2 is probably one of the greatest opportunities and huge threats to the banking industry at the same time.

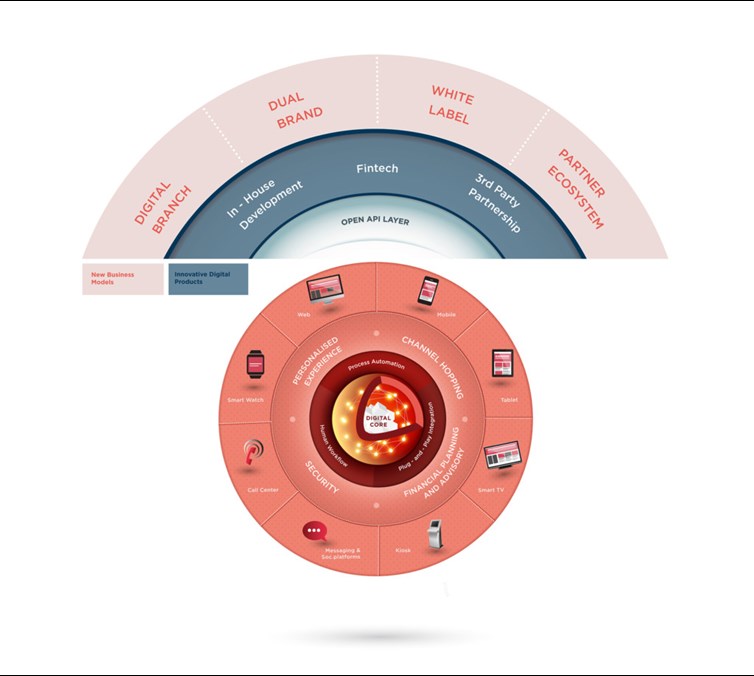

So, it is obvious that banks should react quickly in order to survive in the market. The good news is that more and more banks are investing in digital banking. Unfortunately, most of them look at digital banking as an alternative channel, mobile banking, internet banking, etc. However, it is clear that digital banking is not just a fancy front-end. NF Innova is one of the first companies in this area that recognized this as an opportunity and started talking about digitalization as the new business models end enhanced Bank ecosystem. Could you tell us more about how do you see digital banking and what NF Innova four-pillars customer engagement business model is all about?

NF Innova Digital Banking platform offers an interconnected Omni-channel solution with seamless channel hopping but is also able to recommend the best channel for specific activities. Our solution provides complete end-to-end support not only to bear on PSD2 and open banking opportunities but to get a step ahead with taking full advantage of its opportunities. Independent of which strategic approach the bank decides to follow, NF Innova provides full services and own products support to properly address open banking-based strategic decisions: be it with enabling full digital branch, establishing a new brand and deliver new revenue models, or enabling white-labeling services via a digital platform.

Vaso, we’re very impressed to hear this. Are there any success stories regarding the projects and partners you’ve worked with that you would like to share with us and that are particularly important to you?

It will be my pleasure. I would say – Digital Branch project for Société Générale Bank. Customers of Société Générale are empowered to apply for and enroll in banking products online. Société Générale Serbia is the first bank in Southeastern Europe to offer end-to-end (E2E) automated processes to their customers. Current customers use the digital channels to manage direct debits, term deposits, and standing orders. Customers also apply for current account overdraft, saving accounts, and fast-track loans online. The benefits of implementing a software solution indeed outweighed the costs of change! About 30% of the applicants for current account overdraft use the digital branch. The digital transformation of our operations helped bank account holders to save time. Requesting credit online takes 30 minutes. The end-to-end automation of customer-facing processes reduced the time necessary for credit application by up to 50%. The results are amazing!

Good business model and an effective solution require flawless expertise and technology. The technology of choice, along with system architecture and code quality should support all the requirements of complex business models of banks and banks’ clients. We understand that it’s difficult for NF Innova to find the right outsourcing partner for custom software development, due to the increasing number of companies providing this service, where quantity doesn’t always guarantee the quality of service. Also, it’s quite obvious that NF Innova has set the bar for the quality of service pretty high. Could you describe how and why at some point you chose BrightMarbles as your custom software development partner?

We decided to work with BrightMarbles primarily because of their dedication to work and constant improvement regarding technical skills and expertise. It’s always more of a pleasure to work with a small but dedicated team that understands the importance of a client’s business.

Was it hard for an experienced company such as NF Innova to make a decision to work with a much younger company, with a young team such as BrightMarbles, instead of a big IT company?

It never was a hard decision, taking into consideration we’ve known the management before they founded BrightMarbles. We have witnessed their dedication to problem-solving when working on previous projects from that period. The size of the company doesn’t matter, all that matters is the quality of work and people you’re working with – and believe me, BrightMarbles has it all.

Is there anything you were positively surprised with while working with BrightMarbles?

I was surprised at the amount of passion and dedication their team puts into a project. This is very important and I think the management does a great job of recruiting the right people with the right technical knowledge and personal traits. Another thing I’d like to point out is the way the team members and management get along really well; they discuss everything transparently, joke, and have fun while maintaining a high level of quality of their work.

Okay, are you ready for some fast Q&A? Starting now:

Are you more of a dog person or a cat person? Dog person, definitely

Jobs or Wozniak? Jobs

Skiing or snowboarding? Skiing

Coffee or tea? Tea

PC or MAC? MAC